2024 Defined Contribution Compliance Calendar

For retirement plans subject to ERISA & the Internal Revenue Code

Dates Provided by Priority Pension Services, Inc. (AFI)

So, you are the plan sponsor of a 401K and or Profit-Sharing Plan. An excellent way to attract and retain top talent and receive significant tax deductions for your business! Please note this is for a December 31st year-end, if your year-end is June 30th add 6 months.

Maintaining a plan does not need to be overwhelming. We’ve noted some significant due dates below so there are no surprises. While not comprehensive, it includes most responsibilities to keep you informed and on track.

Self-employed (sole proprietor or partners) owners must make cash or deferred elections no later than the last day of tax year (e.g., by December 31, 2024, for a 2024 calendar tax year). The timing is connected to when the individual’s compensation is “deemed currently available.”

401K deferrals deducted from a participant’s pay must be deposited to the participant’s 401(k) investment account as soon as administratively feasible (as soon as possible).

**Click the Deadline Date for More Information. You can click month to month to view future and past deadlines.**

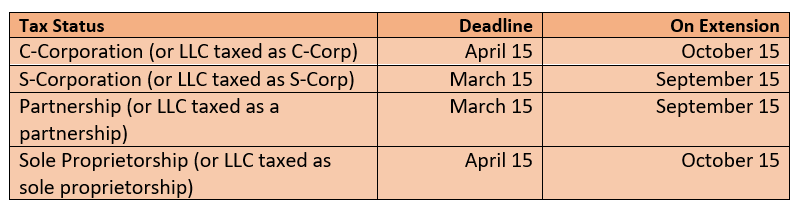

Deductibility Deadlines:

To deduct the employer contributions made to a Defined Contribution plan for a given year, the deposit must be made no later than the due date (including extensions) of your federal tax return.

A summary of the possible deadlines for a calendar year tax filer: