The Inflation Reduction Act was signed into law by President Biden on August 16, 2022. The bill came as a surprise to many as it appeared somewhat out of nowhere after it was believed any legislation was politically dead. We discussed the provisions of the act when originally proposed here and the passed version is materially the same; the changes made will only impact certain taxpayers – those with carried interest, which originally had a provision in the legislation to change the treatment that was ultimately removed. One key change that has gone underpublicized, however, is the extension of the Passthrough Loss Limitations to 2028, which were enacted as part of the Tax Cuts and Jobs Act to and were originally set to sunset in 2025.

Of the tax related provisions of the legislation, the one that will impact taxpayers the most and has equally seen the most coverage has been the increase in IRS Funding by $80 Billion over 10 years. The increase in funding has in turn become a political lightening-rod, with coverage from various sources highlighting the open positions for IRS Special Agents in their Criminal Investigation division (which yes do in fact operate as law enforcement and are authorized to carry firearms) and various coverage related to increase in IRS Examinations.

The additional funding for the IRS comes at a time when the agency does need increased resources. The IRS has operated with a near static budget for the better part of 10 years. The agency had ~79,000 employees in fiscal year 2021, a 12.9% decline in employees since fiscal year 2012. The decrease in staffing, with increased tax complexity and new programs, has lead to challenges for many taxpayers. Many taxpayers are currently experiencing over 12 month wait times for Employee Retention Credit (ERC) refund requests from the IRS for amended returns and most taxpayers are unable to even contact the IRS in an attempt to resolve open tax matters.

Further, the IRS systems, particularly in technology, are outdated and inefficient. While many returns are now “e-filed,” paper returns still require manual IRS processing to enter into the system. The Washington Post had an interesting article showing what it is like inside one of the major IRS Service Centers (Austin, TX) which details the struggles of the agency. The article even shows one technology system operating on Windows XP, which was officially retired by Microsoft in 2014.

As part of the funding, Treasury Secretary Yellen has directed the IRS to “identify specific operational initiatives and associated timelines that will improve taxpayer services, modernize technology” which should move to address some of the above issues, all of which can be easily characterized as “taxpayer positive.” The intent is to try and mitigate the taxpayer stresses related to IRS service which have been increasing over the past few years.

As noted above, the headcount of the IRS has decreased from 2012 to 2021 by about 11,000 employees. The agency also expects that nearly 52,000 employees will be retiring within the next 6 years. The projected hiring from the legislation is roughly 87,000 employees – of which nearly 63,000 could be looked at as replacing what the IRS previously had. The IRS is not currently able to provide a breakdown of the employees retiring, but it will be across all functions of the agency. Treasury officials have noted that revenue agents will not be the main focus of hiring and will include individuals to assist with IT upgrades and customer service representatives.

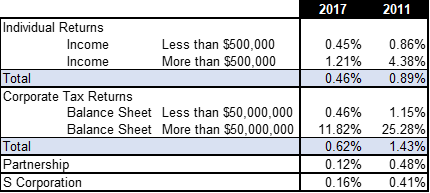

Beyond the above improvements in taxpayer services and infrastructure, legislation also will be used for increased IRS enforcement. In May 2022 the IRS released their compliance statistics which can be found here. The most recently closed statute year was 2017 (meaning generally the IRS has 3 years from date of filing to audit a return; 2017 returns were filed mostly in 2018 and therefore represent the most complete data set). For 2017 .46% of individual income tax returns were examined, with rates of 1.21% for those making above $500,000. .62% of corporate tax returns were examined in that year, with rates of 11.82% for balance sheets greater than $50,000,000, and .12% of partnerships and .16% of S Corporations were examined. These rates are substantially lower than historic levels (2011 is the most recent comparable year):

It is important to note that during this period there was a 5.13% increase in returns filed and a 46.90% increase in returns with more than $500,000 of income. Additionally, there were increases of 18.8% in filed partnership returns and a 13.6% increase in filed S Corporation returns. Overall, the agency has been conducting less examinations on a larger population of returns.

In the memo sent to the IRS from the treasury secretary along with other statements, it has been the stated intention for this funding and any enforcement increase to be 2-fold

- For taxpayers making less than $400,000 per year to return to “historical” levels

- For taxpayers making more than $400,000 to see an increase in examinations

As such, small business and individual taxpayers will likely see an increase in examinations as it returns to historical levels; however, it is not the intention of this legislation to “target” these taxpayers. The higher earning taxpayers will see the majority of the increase both in the return to historical levels and as the legislative intent of the funding.

A treasury official has stated that currently there are only a set number of IRS auditors who are capable of handling complex high net worth returns and it is roughly the same number of agents since World War II. Many of the new hires the IRS is hoping to make in the enforcement areas will be in this area. Additionally, the continually increasing use of pass-through entities such as partnerships and S Corporations will be an interesting potential area for increased examination, particularly partnerships which now may be required to pay any assessment on the partnership level rather than passing out to its partners after the Bi-Partisan Budget Act of 2015.

A few potential caveats still exist in relation to this increased IRS service improvements and enforcement. The directive from Secretary Yellen to return to historical levels and not increase rates for those making $400,000 is not binding for future administrations. The IRS is subject to annual appropriations (this $80 Billion is above that amount, currently); future political changes could lead to increases or decreases in this appropriation.

There exists potential headwinds in relation to hiring these new IRS employees as well. Currently, the marketplace for hiring itself has proven to be very difficult across all industries but has been particularly barren in the accounting, tax and finance areas. As such, the IRS will likely have a difficult time filling all of these positions. Further, by some estimates, it takes three to five years of experience before agents can become fully productive.

In some respects, the increase to IRS funding is a welcome and needed change. The agency has had increasing wait times for support and taxpayer assistance and long waits for return and other document processing, as well as antiquated systems which lead to continual taxpayer frustration. However, taxpayers are weary of any increased IRS enforcement, even if they are doing everything “correct”, as being under the microscope of the IRS can be very stressful and costly. Further, for taxpayers who may have “colored outside the lines” or have positions which are not black and white there may be exposure for increased tax and a higher likelihood of an IRS examination than prior, which can be worrisome.

Edward McWilliams, CPA

Partner

Ed is a Partner in the firm’s tax and business advisory practice focusing on providing services to middle market private companies across different industries as well as to early stage startups. Ed has over a decade of experience providing tax and business consulting services to these companies of different sizes and across different industries, bringing a broad and diverse knowledge base and strategic solutions to the many complex issues that businesses face.