For many of you, the OSC audit is behind you, leaving only the mental scars of a nearly year-long process as a reminder of the importance for your program to maintain adequate records and establish appropriate controls to ensure your school is complying with SED guidelines. For the nearly half of you that have not yet received that inevitable letter, it is important for you to continue to tighten your controls and learn from the OSC audits that have already been issued. The NY State Comptrollers office recently issued its 5th annual summary, providing a synopsis of its findings during its 2018 special education audits.

During 2018, The OSC conducted 17 audits of preschool providers and one audit of a school-age provider. These audits resulted in a cumulative recommended disallowance of almost $14.8 million. This equates to a 3.98% overall disallowance rate, significantly higher than the 2.76% disallowance rate during 2017. In addition, the OSC audits questioned almost $8 million of other costs. With these 18 audits, the OSC has now completed approximately 130 audits, with 14 more audits currently underway.

The findings outlined in the report are fairly consistent with the findings that have appeared over the last few years of audits:

Expenses claimed related to other programs ($2.9 million disallowances): Providers are required to directly charge expenditures to the programs they pertain to. Any costs that cannot be directly charged should be allocated to the various programs based upon appropriate allocation methodologies. Programs should have documented allocation policies and cost allocations should be consistently applied across all programs, even if those programs have multiple funding streams that provide for different reimbursement rules. Allocation of salaries should consider job descriptions and staff responsibilities. If a program director is responsible for all programs, including evaluations, a portion of their salary should be allocated to evaluations.

Unsupported payroll and bonuses ($3.3 million disallowances): Providers are required to maintain appropriate substantiation to support employee work effort. This includes time records that appropriately show time in and time out each day. Time records should be approved by the employee’s supervisor and should coincide with what the employee was paid. Furthermore, salary notices, payroll change forms, contracts, or some other documentation should exist that supports the salary being paid to staff members. From a bonus perspective, remember that bonuses need to be merit-based and should be supported by performance reviews and a bonus policy. The policy should clearly outline how bonuses will be calculated based upon the employee’s performance and the performance reviews should support that the appropriate bonus was given to each employee. Across the board, bonuses are not merit-based.

Unsupported or ineligible OTPS costs ($8.5 million disallowances): All costs charged to programs must be properly supported by receipts or invoices and must be allowable (non-allowable costs are outlined in appendix X of the CFR claiming manual and in the RCM). Programs that have parent companies or entities that provide back-office responsibilities need to ensure that when they are allocating overhead costs, non-allowable costs should be eliminated, fundraising costs should be excluded, and costs charged should not be duplicative in nature. Providers need to have proper purchasing procedures in place that include a bid/quote process to ensure that providers are paying appropriate rates for the goods and services they are purchasing. A few of the disallowances outlined in the report of particular note are:

- Use of consultants where the organization has the expertise to perform the services internally

- Payment of penalties, interest, fines, or late fees

- Vehicle-related expenses without proper logs

- Less-than-arms-length transactions – remember, providers are limited to the lower of fair market value of the services provided or the actual costs to the related party (excluding any non-allowable costs)

- Equipment expensed that should have been capitalized and depreciated

- Unnecessary rent expense

- Excess staffing (staffing levels in excess of classroom ratios)

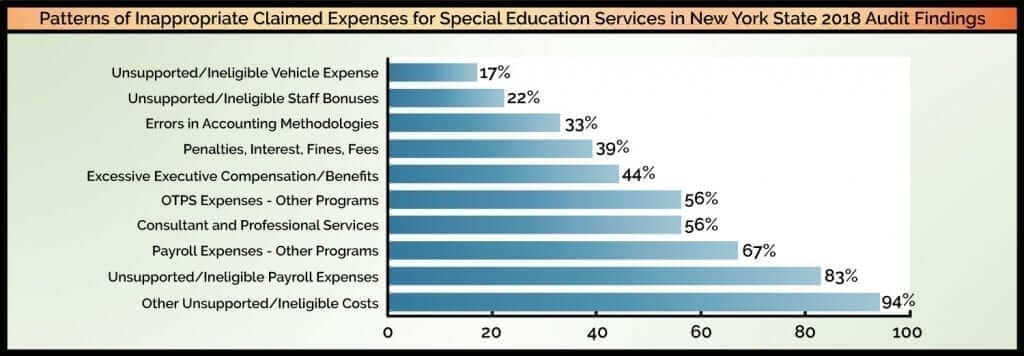

According to the report the following outline the findings with the greatest frequency of occurrences:

Of the 18 audits completed during 2018, two were from upstate, 4 were Westchester/Rockland, and the remaining 12 were NYC and Long Island. Even though the auditors came in to perform a one-year audit, 14 of the 18 audits were expanded to encompass three years.

The report also cited auditing firms for lack of due diligence during the audit process. The OSC believes that appropriate audits would have identified many of the findings that were noted during the OSC audits.

The OSC audits are still happening, and they will continue to happen until all providers have gone through the process. These audits continue to stress the importance of proper controls and oversight and the need to ensure you understand and comply with the CFR claiming manual and the Reimbursable Cost Manual. Providers should also keep in mind that just because they’ve already gone through an OSC audit, it doesn’t mean the OSC won’t come back in the future, or you won’t be audited by one of your other funders. In NYC, the Board of Education has started to do specific reviews of IDEA funding and full programmatic reviews. It’s clear that audits are now part of the landscape that SED providers need to deal with. Embrace them… you don’t really have a choice.

This article was also featured in our newsletter Special Ed-ition Vol. 21

Albert Borghese, CPA

Director

Albert is a member of Cerini & Associates’ audit and consulting practice where he focuses on serving the firm’s special education and nonprofit clients. Albert is also involved in the marketing and development of the firm, and frequently participates in recruiting efforts, and research.