One of the most anticipated and popular provisions in the CARES Act is the expansion of Small Business Administration (SBA) 7(a) Loans with new Paycheck Protection Program loans. These loans are non-recourse to owners, 100% Federally guaranteed and can be used to pay payroll and rent during the economic uncertainty ahead as a result of the COVID-19 outbreak.

This guide has been prepared with all available information as of March 29, 2020. We are eagerly awaiting regulations from the SBA to help provide needed clarity and guidance and for lenders to begin to originate these loans.

We would like to emphasize that these loans are not guaranteed to be granted to any borrower nor is any forgiveness guaranteed.

Eligible Borrowers, Terms, Permitted Uses of Paycheck Protection Loans

Given the high level of economic uncertainty, particularly with smaller (less than 500 employees) organizations, the CARES Act looked to increase the eligibility for this loan program to include companies with less than 500 employees, including 501(C)(3) nonprofits.

Loan Conditions and Eligibility Requirements

Loan Conditions and Eligibility Requirements

The CARES Act states the following eligibility and certification requirements for borrowers. It is anticipated that any application will cover these certifications. In addition, there are certain factors that lenders will not look for in making these loans.

Loan Size

Loan Size

The loans are limited to a maximum of 2.5 times your average monthly eligible monthly payroll costs or $10,000,000.

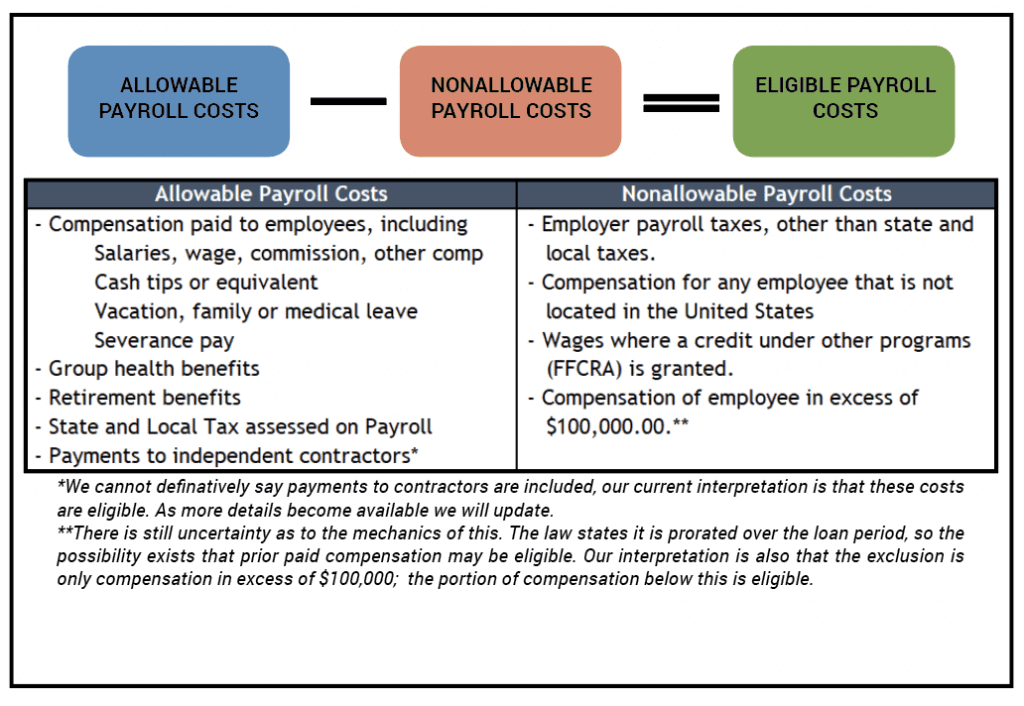

Calculation of Eligible Payroll Costs

Calculation of Eligible Payroll Costs

The calculation of eligible payroll costs is as follows:

Recommended Documents

As mentioned in our foreword, the SBA and lenders are working on getting these loans available as soon as possible. Based on what we know so far, it is our belief and understanding most businesses will get these loans via their current relationship with a bank. As no application is available yet, we recommend that borrowers gather the following documentation to be prepared for these loans. Not all of this information will likely be needed for the application and there may be some streamlined processes with lenders and the SBA to originate these loans.

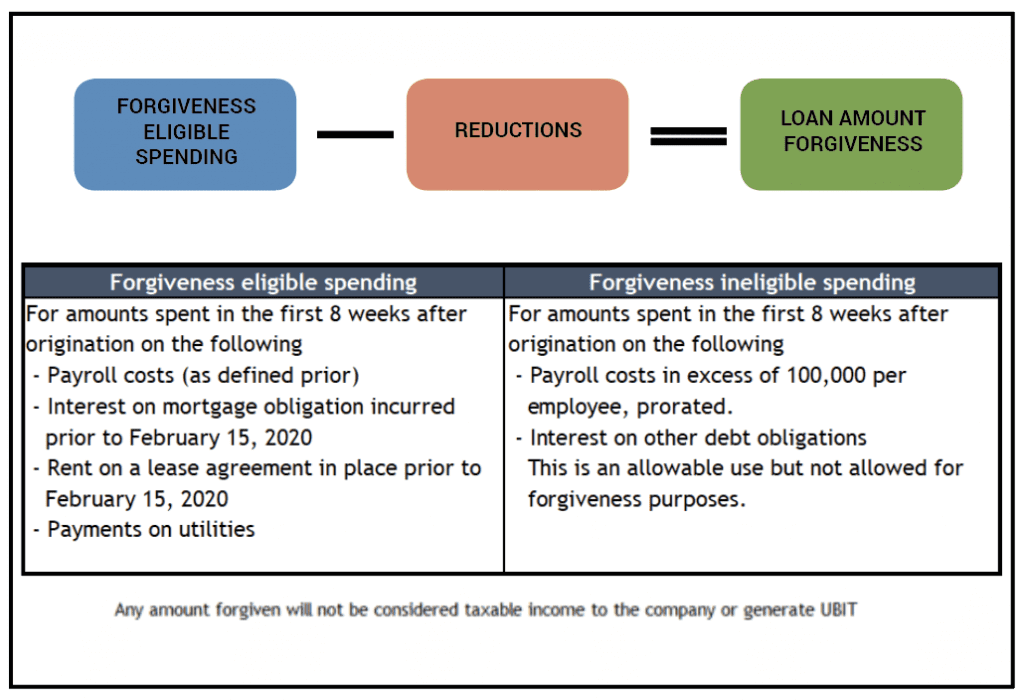

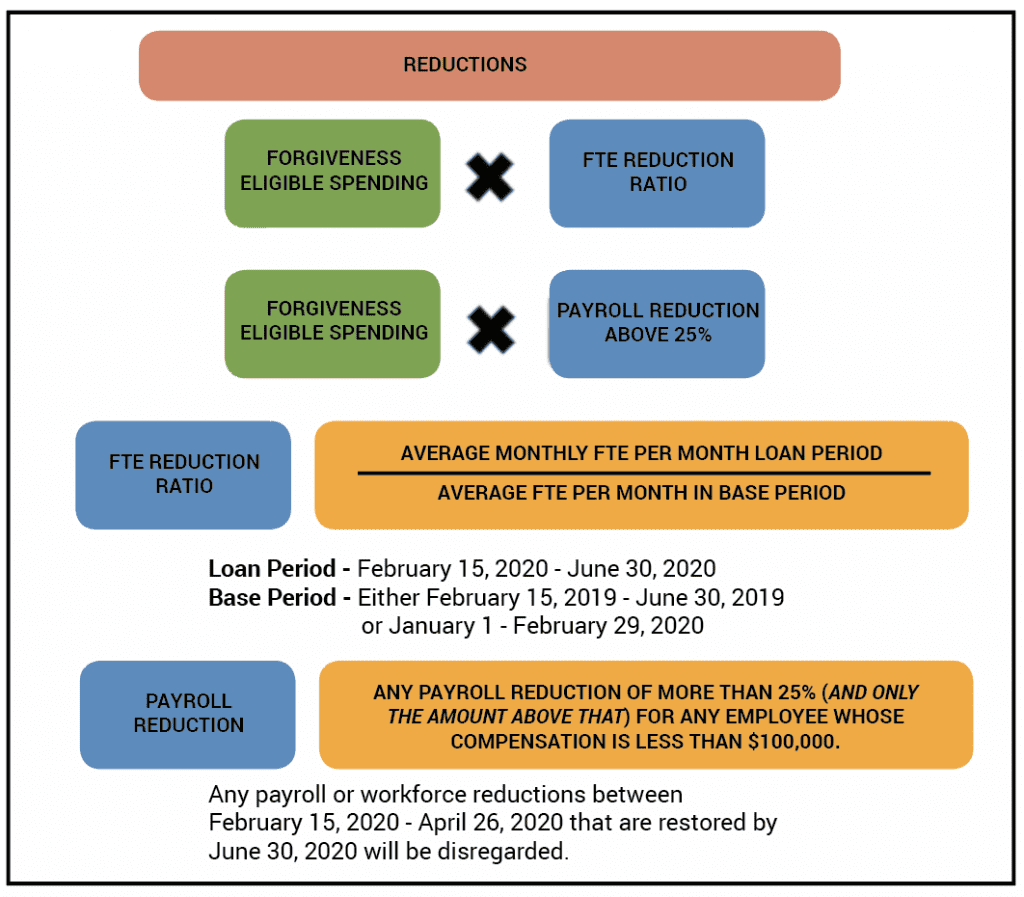

Loan Forgiveness

Loan Forgiveness

The popularity of this program is driven largely by the potential loan forgiveness features. The law provides that up to the full amount of principal of the loans may be forgiven, depending on certain uses of the proceeds, staffing and payroll levels. This forgiveness will not be considered taxable income.

As more guidance comes from the SBA and lenders, including the application process, we will share as quickly as we can.

Edward McWilliams, CPA

Partner

Ed is a Partner in the firm’s tax and business advisory practice focusing on providing services to middle market private companies across different industries as well as to early stage startups. Ed has over a decade of experience providing tax and business consulting services to these companies of different sizes and across different industries, bringing a broad and diverse knowledge base and strategic solutions to the many complex issues that businesses face.